FASTag is an electronic toll collection system in India, introduced by the National Highway Authority of India (NHAI). It enables automatic deduction of toll charges, ensuring hassle-free travel across toll plazas.

Linked directly to your bank account or prepaid wallet, FASTag uses Radio Frequency Identification (RFID) technology to process toll payments.

However, there might be scenarios where you need to deactivate your FASTag, such as selling your vehicle, switching to a different provider, or closing your linked account. This guide provides a step-by-step explanation of how to deactivate your FASTag online.

What is FASTag?

FASTag is an electronic toll collection system operated by the National Highway Authority of India (NHAI). It uses Radio Frequency Identification (RFID) technology to automatically deduct toll charges, eliminating the need to stop cash transactions. FASTag is linked to your bank account or a prepaid wallet, ensuring seamless toll payments across national highways.

Why Deactivate FASTag?

There are several reasons why you might want to deactivate your FASTag:

1. Selling Your Vehicle

When you sell your vehicle, the FASTag is linked to the vehicle’s registration details. If you do not deactivate or transfer the tag, it could still be used by the new owner, potentially leading to unauthorized charges or misuse. Deactivating the FASTag ensures that it cannot be used on any other vehicle after the sale of your car, protecting your account and preventing unwanted toll deductions.

Additionally, if the vehicle’s registration details are changed during the sale, the FASTag may become invalid, leading to unnecessary complications.

2. Switching Banks or Service Providers

FASTags are linked to your bank account or the service provider of your choice. If you’re unhappy with your current service provider due to issues such as customer service, toll rate hikes, or other offers, you might consider switching to another bank or provider.

In such a case, deactivating your current FASTag and obtaining a new one linked to your new bank or provider ensures that your new provider can manage your toll payments efficiently.

This also gives you the benefit of better service, competitive offers, and sometimes lower toll rates, making it a good reason to deactivate the existing tag and set up a new one.

3. Loss or Theft of FASTag

In unfortunate circumstances where your FASTag is lost or stolen, it’s crucial to deactivate it immediately to prevent any potential misuse. If the FASTag falls into the wrong hands, someone could attach it to their vehicle, and toll charges could be deducted from your linked account without your consent.

Deactivating the FASTag upon loss or theft and getting a replacement ensures that your financial information is secure. Many FASTag providers allow you to report the loss and deactivate the tag online, providing immediate protection against unauthorized use.

4. Damaged FASTag

FASTags are typically adhesive, and over time, they may become damaged due to wear and tear, exposure to the elements, or other physical factors. A damaged FASTag might not function properly, leading to failed toll deductions or delayed payments at toll plazas.

In this case, it’s advisable to deactivate the old FASTag and replace it with a new one. This ensures that your travel experience remains smooth and uninterrupted, and toll payments continue without issues.

A replacement tag is easy to acquire, and many service providers offer it at no additional cost, making it a simple process to keep your FASTag in working condition.

5. Changing Vehicle Type

If you change your vehicle (for instance, upgrading from a two-wheeler to a four-wheeler or vice versa), the FASTag linked to your old vehicle may no longer be valid for your new one.

FASTags are specifically designed for each vehicle’s registration details and cannot be transferred directly from one vehicle to another. In such cases, it’s necessary to deactivate the FASTag linked to the old vehicle and obtain a new one for the new vehicle. This ensures the correct vehicle details are associated with the FASTag and helps avoid confusion or delays at toll plazas.

6. Upgrading to New FASTag Technology

Technology evolves rapidly, and new FASTag models or systems might be introduced by service providers, offering better features such as enhanced security or faster transaction processing.

If you wish to upgrade to a new FASTag with better functionality, deactivating the old one is necessary to avoid conflicts between old and new systems. This allows you to switch to the upgraded FASTag seamlessly without any issues.

Things to Consider Before Deactivating FASTag

- Clear all outstanding dues or toll charges.

- Check for any linked accounts and ensure proper closure.

- Download your transaction history for future reference.

General Procedure How to Deactivate FASTag Online

The deactivation process can vary depending on the issuing bank or provider. However, the general steps are quite similar across platforms. Here’s a step-by-step guide:

Step 1: Log into Your FASTag Account

- Visit the official website or mobile app of the issuing bank or wallet provider (e.g., Paytm, ICICI Bank, HDFC Bank, Airtel Payments Bank).

- Enter your registered mobile number, customer ID, or email address along with your password to log in.

Step 2: Navigate to FASTag Services

- Once logged in, locate the ‘FASTag’ section in your account dashboard.

- Select ‘Manage FASTag’ or a similar option.

Step 3: Select the FASTag Account to Deactivate

- A list of active FASTag accounts will appear.

- Choose the FASTag linked to the vehicle you wish to deactivate.

Step 4: Submit Deactivation Request

- Look for the ‘Deactivate’ or ‘Close Account’ option.

- You may need to provide a reason for deactivation.

- Confirm the action by entering the One-Time Password (OTP) sent to your registered mobile number.

Step 5: Confirmation of Deactivation

- Once submitted, you’ll receive a confirmation message or email.

- The deactivation process usually takes 24-48 hours.

Step-by-Step Process to Deactivate FASTag Online

1. Deactivating FASTag via the Bank’s Portal

If your FASTag is issued by a bank, you can deactivate it through the respective bank’s website or mobile app. Here’s how:

Step-by-Step Guide:

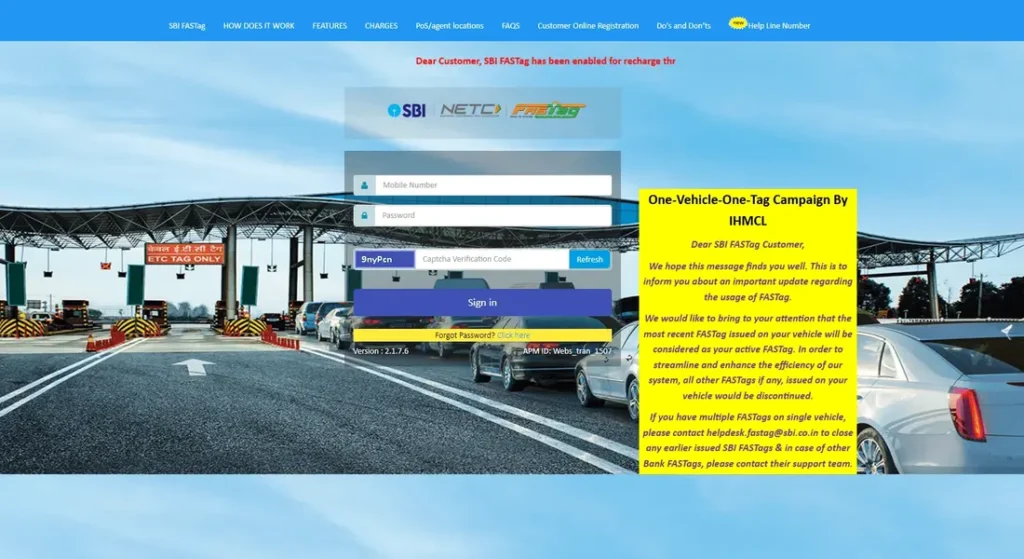

- Log In to your bank’s FASTag portal or mobile app.

- Navigate to the FASTag section.

- Select the FASTag account you wish to deactivate.

- Click on ‘Close’ or ‘Deactivate’ FASTag.

- Confirm the deactivation request.

Banks like ICICI Bank, HDFC Bank, SBI, and Axis Bank provide online deactivation options.

2. Deactivating FASTag via Customer Care

Most banks and FASTag issuers offer customer care services to deactivate FASTag.

Step-by-Step Guide:

- Call the customer care number of your issuing bank or provider.

- Provide your registered mobile number and FASTag details.

- Request deactivation.

- You may receive an OTP for confirmation.

- Once verified, your FASTag will be deactivated.

Provider-Specific Deactivation Process

1. Paytm FASTag

- Open the Paytm app and go to ‘Manage FASTag’.

- Select the vehicle number you want to deactivate.

- Click on ‘Help & Support’ > ‘Issue with FASTag’ > ‘Close FASTag’.

- Submit the request and receive confirmation within 24 hours.

2. ICICI Bank FASTag

- Log in to the ICICI FASTag portal.

- Navigate to ‘Service Request’ > ‘Closure Request’.

- Enter the necessary details and submit.

- Deactivation is usually processed within 2 business days.

3. HDFC Bank FASTag

- Access your HDFC FASTag account online.

- Go to ‘Tag Closure Request’.

- Fill in the vehicle details and submit the form.

- Receive confirmation after the request is processed.

4. Airtel Payments Bank FASTag

- Log into the Airtel Thanks app.

- Click on ‘Banking’ > ‘FASTag’.

- Choose the FASTag you wish to deactivate.

- Click ‘Deactivate’ and confirm via OTP.

Alternative Methods to Deactivate FASTag

In addition to online methods, other ways to deactivate FASTag include:

- Customer Care: Call the customer support number of your FASTag issuer and request deactivation.

- Email: Send an email to the issuer’s customer service with your account details and deactivation request.

- Visit Bank Branch: Physically visit the bank branch and fill out a FASTag closure form.

Important Points to Remember

- Clear Dues: Ensure all pending toll charges are cleared before initiating deactivation.

- Balance Refund: Some issuers refund the balance after deducting any applicable charges.

- Time Frame: Deactivation typically takes 24-48 hours, but it may vary depending on the provider.

- Proof of Deactivation: Always save the confirmation email or SMS for future reference.

FAQs on FASTag Deactivation

Q1: Can I transfer my FASTag to another vehicle?

No, FASTag is vehicle-specific. You must deactivate the old one and purchase a new FASTag for the new vehicle.

Q2: Will I get a refund of the balance after deactivation?

Yes, most issuers refund the remaining balance to your linked account after deducting applicable charges.

Q3: Can I reactivate a deactivated FASTag?

No, once deactivated, you cannot reactivate a FASTag. You need to purchase a new one.

Q4: How long does it take to deactivate a FASTag?

It generally takes 24-48 hours, but this may vary by provider.

Conclusion

Deactivating your FASTag online is a simple and secure process when done through the right channels. Whether you are selling your vehicle or switching service providers, timely deactivation ensures that your FASTag is not misused.

By following the steps outlined for your respective provider, you can easily manage your FASTag account and safeguard your finances.