FASTag has revolutionized the way we travel on highways by enabling seamless toll payments without the need for cash transactions. This RFID (Radio Frequency Identification) technology not only saves time but also reduces fuel consumption by avoiding long queues at toll plazas.

However, to ensure a smooth journey, keeping track of your FASTag balance is crucial. In this article, we will explore how you can check your FASTag balance through different banks like HDFC, ICICI, SBI, and others, and discuss common methods available for all FASTag users.

What is FASTag?

FASTag is a prepaid tag affixed to the windshield of your vehicle that automatically deducts toll charges as you pass through toll plazas. It is linked to your bank account or wallet and ensures quick and cashless toll payments. Since toll charges are deducted electronically, monitoring your FASTag balance is essential to avoid insufficient funds and potential disruptions during your journey.

How to Check FASTag Balance Through Popular Banks Like SBI, HDFC, ICICI Bank

Different banks provide various methods for their customers to check FASTag balances. Here’s a detailed guide for some of the most popular banks offering FASTag services:

1. HDFC Bank FASTag Balance Check

HDFC Bank offers multiple options for checking your FASTag balance:

- Via Mobile App: Download and log in to the

- HDFC Bank PayZapp or the FASTag-specific app. Navigate to the FASTag section in the app to view your current balance and transaction history.

- Via SMS Alerts: Registered users receive SMS notifications after every transaction or recharge. These alerts include your updated FASTag balance, ensuring you stay informed.

- Via Customer Care: If you need additional assistance, you can call the HDFC FASTag customer care helpline at 1800-120-1243. Provide your registered mobile number or vehicle details to get your balance details.

- Via Email: HDFC Bank also sends periodic email updates to registered users, summarizing their FASTag account activity.

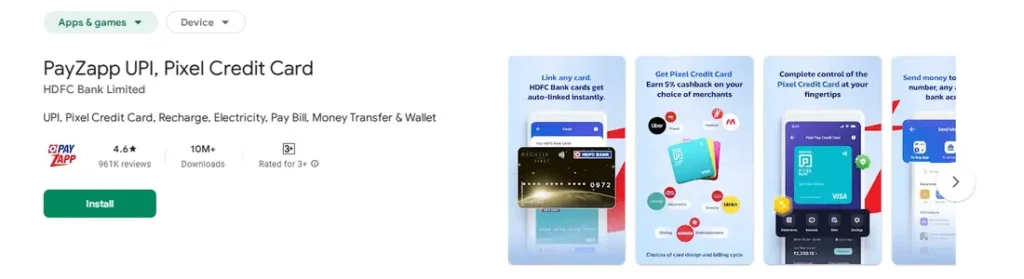

2. ICICI Bank FASTag Balance Check

ICICI Bank makes it easy to check your FASTag balance with these options:

- Via iMobile Pay App: Log in to the iMobile Pay app, navigate to the FASTag section, and view your balance. This app provides a user-friendly interface for managing your FASTag account.

- Via SMS Alerts: After each toll transaction or recharge, ICICI Bank sends SMS updates to your registered mobile number, displaying the remaining balance.

- Via Website: Visit the ICICI FASTag Portal, log in with your credentials, and access detailed information about your balance and transactions.

- Via Toll-Free Number: ICICI Bank offers customer support at 1800-210-0104, where you can inquire about your FASTag balance by providing the necessary account details.

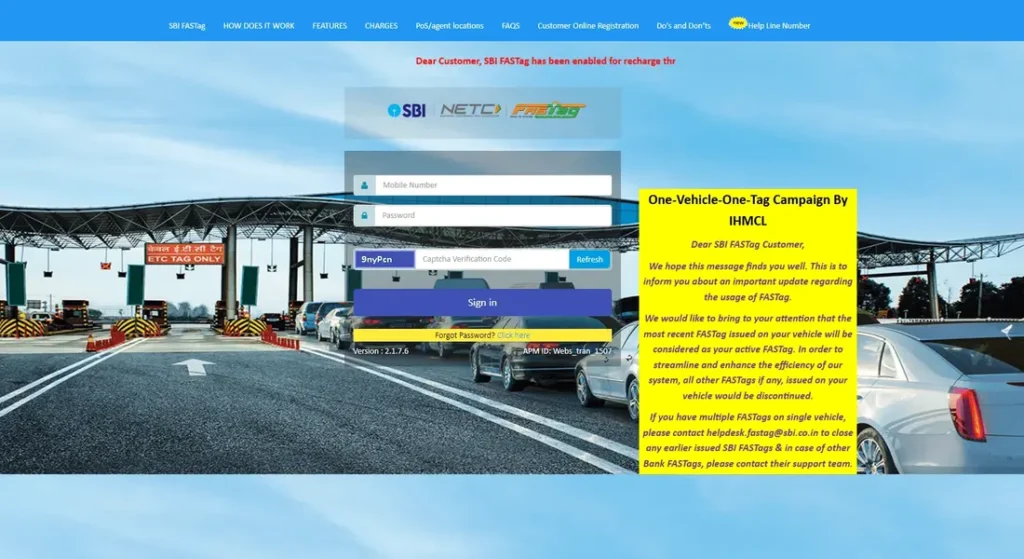

3. SBI FASTag Balance Check

State Bank of India (SBI) provides several convenient methods for checking FASTag balances:

- Via SBI YONO App: Log in to the SBI YONO app, navigate to the FASTag services section, and check your balance in a few simple steps.

- Via SMS Notifications: Similar to other banks, SBI sends automatic SMS alerts to registered users after every transaction, keeping you updated about your account balance.

- Via Customer Support: You can call the SBI FASTag helpline at 1800-11-0018 to inquire about your balance. Make sure to have your registered mobile number or vehicle details handy.

- Via Website: Login to the SBI FASTag Portal using your credentials to view your balance and transaction history.

4. Other Banks Offering FASTag Services

Several other banks, such as Axis Bank, Punjab National Bank, and Kotak Mahindra Bank, also provide FASTag services. The methods for checking balances are generally similar across banks:

- Mobile Banking Apps: Log in to the respective bank’s mobile app and navigate to the FASTag section.

- Customer Support: Call the bank’s toll-free number for FASTag-related queries.

- SMS Notifications: Most banks send SMS alerts for transactions and balance updates.

- Bank Portals: Use your bank’s FASTag portal for detailed account management.

Common Methods to Check FASTag Balance

If you are unsure which bank issued your FASTag or prefer generic methods to check your balance, you can use the following universal options:

1. MyFASTag App

The MyFASTag app is a centralized platform developed by the National Payments Corporation of India (NPCI). It allows you to:

- Check your FASTag balance.

- Recharge your FASTag account.

- Link your FASTag to your preferred bank account or wallet.

Simply download the app, register using your vehicle details or FASTag ID, and access your balance information instantly.

2. NHAI FASTag Portal

The National Highways Authority of India (NHAI) provides a FASTag portal where users can:

- Log in with their credentials.

- Check balance details.

- View transaction history.

- Recharge their FASTag account.

Visit the official website and log in to manage your FASTag account.

3. SMS Notifications

Once your FASTag is registered, you will receive SMS notifications from your issuing bank for every transaction, recharge, or deduction. These messages include details about your updated balance, making it easy to track your account without additional steps.

4. Toll-Free Customer Care

Most FASTag-issuing banks offer toll-free numbers to assist users. By calling the customer care helpline and providing your registered mobile number or vehicle details, you can easily check your FASTag balance.

5. Recharge Platforms

Popular platforms like Paytm and Google Pay, if linked to your FASTag, allow you to check your balance and recharge directly from their apps. Navigate to the FASTag section in these apps to view balance information.

Tips for Managing Your FASTag Account

- Keep Your Mobile Number Updated: Ensure your registered mobile number is active to receive SMS alerts and account updates.

- Monitor Transactions Regularly: Periodically log in to your bank’s app or portal to review transaction history and ensure there are no discrepancies.

- Set Auto-Recharge Options: Many banks offer auto-recharge facilities to maintain a sufficient balance. Enable this feature to avoid disruptions during travel.

- Use Unified Apps: Apps like MyFASTag and NHAI FASTag Portal provide a centralized platform for managing FASTag accounts, irrespective of the issuing bank.

- Report Issues Promptly: If you encounter any discrepancies in transactions or balance updates, contact your bank’s customer support immediately for resolution.

FAQs on Checking FASTag Balance

1. What is the easiest way to check my FASTag balance?

The easiest way to check your FASTag balance is through the MyFASTag app or the mobile banking app of your issuing bank. Both platforms provide instant balance updates.

2. Can I check my FASTag balance without a smartphone?

Yes, you can check your FASTag balance without a smartphone by using SMS notifications sent by your bank after every transaction or by calling the customer care helpline of your issuing bank.

3. What happens if my FASTag balance is insufficient?

If your FASTag balance is insufficient, you may be denied access at toll plazas or have to pay the toll fee manually. Some toll plazas may also impose additional charges for insufficient FASTag balances.

4. How can I check my FASTag balance if I forget the issuing bank?

You can use the MyFASTag app to check your balance without knowing the issuing bank. The app links directly to your FASTag account based on your vehicle details.

5. Do all banks provide SMS alerts for FASTag transactions?

Yes, most banks offering FASTag services send SMS alerts to the registered mobile number after every transaction or recharge.

Conclusion

FASTag has simplified toll payments, making travel faster and more efficient. However, maintaining a sufficient balance is crucial to avoid disruptions at toll plazas. Whether you are using FASTag services from HDFC, ICICI, SBI, or any other bank, checking your balance is easy through mobile apps, SMS alerts, customer care, or bank portals. Additionally, generic platforms like the MyFASTag app and NHAI FASTag Portal offer convenient alternatives for balance checks and account management.

By staying proactive and using these methods, you can ensure a smooth and hassle-free travel experience on highways. Make sure to recharge your FASTag on time and keep your account details updated for seamless toll transactions.